Electric cooperatives deliver power to 42 million Americans, and those local co-ops tend to be well known in the communities they serve. At a minimum, people know who they write a check to each month, and some co-op members get more involved with their co-ops by running for the board of directors, attending meetings, and working to ensure that co-ops are upholding their commitments to democratic control.

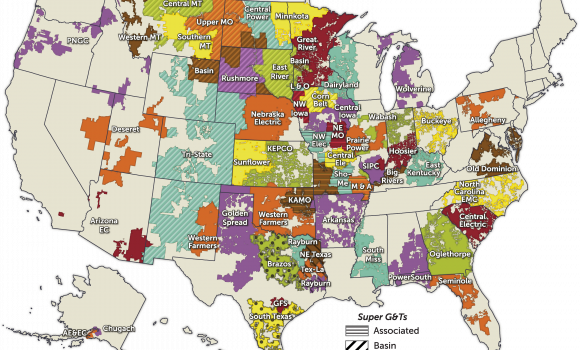

What’s less well known is that most electric cooperatives are themselves members of larger cooperatives, known as generation and transmission associations (or “G&Ts” within the industry). These generation and transmission associations own and operate large power plants and deliver that power to local electric cooperatives, which in turn distribute electricity to homes and businesses across the United States.

Generation and transmission associations aren’t often well known because they don’t show up on electric bills. But they can have a major impact on local electric cooperatives’ power supply, rates, and even a co-op’s ability to respond to its members concerns.

One generation and transmission association is becoming better known to co-op members in the Rocky Mountain West. Tri-State Generation and Transmission Association is one of the largest G&Ts in the country, delivering power to 43 electric cooperatives in Colorado, New Mexico, Wyoming, and Nebraska.

Like many other G&Ts, most of the power that Tri-State generates comes from coal fired power plants. But in recent years, renewable energy prices have declined so much that building new wind and solar projects can now often deliver power at a lower price than running existing coal plants. And many electric cooperatives’ vast, mostly rural service territories offer abundant opportunities to capture those local renewable energy resources.

But the contracts that local electric cooperatives signed with Tri-State limit co-ops from developing local renewable energy projects, even when those projects would lower costs for co-ops and their members. That’s creating tension between Tri-State and some of its member co-ops.

In response, some of Tri-State’s largest member co-ops are pushing for changes that will allow them to stabilize electric rates, deliver a cleaner power supply, and meet the expectations of their members.

Tri-State's largest member co-op, United Power, has proposed changes to Tri-State’s bylaws to give co-ops more flexible contract options, so they can purchase power from other providers and pursue more local renewable energy projects. United Power has been discussing its proposal with other Tri-State member co-ops, warning that Tri-State policies are turning away large customers.

United Power built several solar projects, and in 2017 reached the limit on local energy development imposed by Tri-State. So United shifted its strategy to energy storage projects, and installed a 4 megawatt Tesla Powerpack, now the largest battery in Colorado. But Tri-State pushed back, and last year changed its policies to discourage its member co-ops from pursuing energy storage projects.

Tri-State's second largest member co-op, Poudre Valley Electric Association, passed a resolution in September of last year that "requests Tri-State to develop policies that work on providing member-side electric supply resources, so Poudre Valley can actively participate with retail members who opt to move to such resources."

La Plata Electric, Tri-State's third largest member co-op, formed a power supply committee last year to study the possibility of switching to a different power supplier. La Plata Electric is also urging more flexibility from Tri-State, and seeking answers about how Tri-State manages its debt, out of concerns that could lead to higher rates in the future.

Some co-ops have decided they’re better off without Tri-State. Kit Carson Electric in northern New Mexico ended its contract with Tri-State in 2016, and began buying wholesale power from Guzman Energy instead. Kit Carson is aiming to generate 100% of its daytime energy needs with solar power by 2022, now that it isn’t blocked from building local solar projects.

In Colorado, Delta-Montrose Electric is now also seeking to end its contract with Tri-State to pursue more local renewable energy and cheaper wholesale power rates. Tri-State has tried to block that as well, seeking to charge Delta-Montrose Electric a much higher fee to end its contract than the $37 million that Kit Carson Electric paid.

Now the dispute has landed at the Colorado Public Utilities Commission, which said last month that it will determine how much Delta-Montrose Electric has to pay to end its contract with Tri-State. The case has attracted statewide attention, and the participation of industry associations, advocacy groups, several other co-ops, a majority of Colorado state lawmakers, and the state energy office.

For hundreds of thousands of co-op members in the Rocky Mountain West, the outcome of these co-ops’ efforts to change Tri-State will go a long way in shaping how our region will transition from coal to cleaner energy. For millions of co-op members across the country, it’s an indication of the important role of generation and transmission associations on electric cooperatives’ rates, power mix, and local democratic control.

Joe Smyth is an independent researcher who writes about how electric cooperatives are navigating the energy transition at cleancooperative.com